Next year EU members will confront new European Commission proposals intended to get them to buy more from each other’s defense industries — and probably Ukraine’s, too — and less from the United States.

Contrary to some reports, Canada’s agreement to join the EU loans-for-arms program SAFE (Security Action for Europe) does not lift a 35% cap on Canadian-made components in end products assembled in Europe. It allows the purchase of end products assembled in Canada that contain at least 20% European components.

NATO has announced 150 startups chosen for its 2026 defense innovation program.

EU leaders will meet this week to discuss EU capabilities in drones, electronic warfare and air defense, as well as the role of the European Defence Agency.

Welcome to The Arsenal Europe, a weekly newsletter for European defense tech and sister publication to The Arsenal Ukraine — formerly known as Counteroffensive.Pro.

Only want to get the Ukraine issue? Change your subscriber settings here.

***

Our publication will be putting up a paywall in the new year. Interested in our B2B subscription packages? Register here to learn more.

If this email was forwarded to you, you can subscribe here and don’t miss our emails.

Europe’s pork-barrel procurement problem

The European Commission is expected to propose a full rewrite of the EU’s Defence Procurement Directive next year, which is already going through a short-term revision to prune red tape.

The directive lays down common rules for member states to incorporate into national law. They include a general obligation to open large procurement opportunities to competitive bids from across the EU and to publish them on Tenders Electronic Daily (TED), the bloc’s public procurement platform.

The Commission wants to address obstacles to cross-border procurement, according to its call for evidence.

It’s also considering a ‘European preference,’ which it hopes would encourage member states to buy more within Europe and less from foreign suppliers.

“We need to be strategically way more sovereign when it comes to our defense industry,” Commission defense spokesman Thomas Regnier told The Arsenal. “We should definitely revise our procurement rules to not always choose the cheapest option, but to choose a strategic European option.”

He said the proposal is planned for the second quarter of next year.

DEFENSE INDUSTRY TAKEAWAY: More open tendering would benefit smaller defense firms that don’t have the government connections. A ‘European preference’ could mean more orders for EU defense companies—and probably Ukrainian firms —at the expense of foreign suppliers. It could also threaten partnerships between European and U.S. defense firms. The Commission has invited industry representatives to submit their opinions by 17 February.

Next year’s proposal will be more ambitious, Regnier told The Arsenal.

Member states can easily bypass the directive by invoking national security exemptions in the EU’s fundamental treaties. Some countries, particularly Poland, do it to skip a long tendering process. For others, especially France, it’s also a way to support domestic industries.

Rewriting the directive can’t do away with those exemptions because they’re enshrined by treaty. A rare treaty amendment, which requires unanimity, is not on the table.

The Commission’s goal is to persuade member states to use the exemption less by making the directive more flexible. An EU official, who asked to remain anonymous to speak candidly, estimated that reform could cut procurement time by a few months, at most.

The official told The Arsenal that introducing a ‘European preference’ will persuade member states with large national defense industries, like France, to open more of their defense tenders to European competition.

A source in the German defense industry laughed at that suggestion.

The source, who also asked not to be named due to commercial sensitivities, said defense policy and industrial policy are closely intertwined in France.

“The German Ministry of Defense doesn’t have that industrial perspective at all,” but Berlin also uses the exemption for expediency, the source said.

How the ‘European preference’ might work

The current directive does not require member states to give preference to European suppliers, but case law has established that there is no requirement to accept tenders from outside the EU and the European Free Trade Area, the EU official said.

A ‘European preference’ exists in SAFE, which requires that no more than 35% of the cost of the components of the product being procured come from outside the EU, EFTA or Ukraine. A similar rule exists in the European Defence Industrial Programme (EDIP), a grant scheme.

There are no details yet, but the EU official told The Arsenal that the forthcoming ‘European preference’ rule will probably be “inspired by SAFE”—that is, likely to include Ukraine but not the UK.

The German industry insider suggested that the Commission might propose benefits from buying within the EU, such as fast-track procedures for equipment below the 35% limit, but doubts that the EU chamber representing national governments would approve it.

Squeezing foreign components could have knock-on effects for European defense firms that collaborate with foreign suppliers, the German industry insider said. For example, Italy’s supply of F-35s is assembled on Italian soil in a partnership between Lockheed Martin and Leonardo.

The EU official said the new proposal will likely be for a regulation, meaning a law that applies directly throughout the EU. That is different from a directive, which sets rules that have to be included in national laws.

Big vs small

Whether or not a ‘European preference’ can make it into EU procurement law is to some extent a numbers game.

The population-based voting procedures for most EU laws give a lot of power to the largest countries. That means Germany, France and Italy, followed by Spain and Poland, have the greatest influence.

Coalitions of small states, if backed by a couple of large ones, can overcome that disadvantage.

French officials advocated strongly for a ‘European preference’ or ‘buy European’ policy when SAFE and EDIP were still on the table. Polish officials were more skeptical, highlighting the need to buy the best equipment quickly.

“A member state that has a large defense industry will be more tempted to try to buy from its domestic industries,” said the EU official.

The official pointed to Germany, France, Italy, Spain and Sweden—home to major defense firms such as Rheinmetall, KNDS, MBDA, Thales, Dassault, Leonardo, Indra Sistemas and Saab.

But the official added even countries with much smaller industries will use the exemption to buy domestically “in some domains.” For instance, the Netherlands buys naval vessels from Dutch shipbuilder Damen Shipyards.

Export opportunities

Industrial size isn’t the only factor: Exports matter too.

France is the world’s second-largest arms exporter after the United States, according to the Stockholm International Peace Research Institute (SIPRI). Only 9.1% of those exports went to Europe during 2019-2023. Asia and Oceania received 42% of the total, and 39% went to the Middle East.

The French are playing an “interesting game,” the EU official said, because Paris sees an export opportunity in Europe, despite its use of national security exemptions that could undermine that opportunity.

“They are very much in favor of a system of European preference,” the official added.

If the principle were added to defense procurement law, “France would probably stop invoking national security to buy from French companies—but French companies would be selling to Poland,” rather than Poland buying from the US.

The Nordic states, with the exception of Denmark, have large defense industries relative to their size. Phillip Kjær Luscombe, who advises Nordic defense firms for Rasmussen Global, said that makes big exports “very important to the domestic industries” and trade barriers “very damaging.” He added that there’s a push for “inter-Nordic joint procurement.”

As for Germany, the world’s fifth-largest exporter after Russia and China, Kjær Luscombe pointed out that Europe already accounts for a large share of its defense exports—25%, according to the SIPRI data.

AI in Defence Summit 2026 in Brussels:

Europe’s Flagship AI and Defence Event

When: 2 February 2026

Where: The European Commission

Goal: To accelerate breakthroughs in European Defence through dual-use innovation.

The AI in Defence Summit is Europe’s premier gathering to align institutional leaders, cyber commands, and the deep-tech ecosystem on the critical role of Artificial Intelligence in strengthening European Defence. Confirmed participants include the European Investment Bank, European Innovation Council, European Investment Fund, European Defence Agency, NATO and the European Commission.

Check out the agenda: https://aidefencesummit.eu/agenda

Register here: https://aidefencesummit.eu

Interested in sponsoring The Arsenal?

In over a year, we’ve accumulated more than 2,700 subscribers focused on Ukrainian battlefield innovation. This includes Western primes, defense companies, allied governments, and Ukrainian startups. Want your messaging to target this highly-sought-after demographic?

1. Non-EU component cap stays put in Canada-EU loans-for-arms deal

Contrary to some reports, Canada’s SAFE participation doesn’t allow Canadian-made components to exceed a 35% value limit for end products assembled in Europe, Commission defense spokesman Thomas Regnier told The Arsenal on Friday.

Instead, the deal allows SAFE to finance the procurement of end products assembled in Canada, provided they contain at least 20% European components, Regnier said. It also allows the Canadian government to take part in joint procurement with EU countries—the main point of the agreement.

DEFENSE INDUSTRY TAKEAWAY: Canada joined SAFE to participate in joint procurement. That will create opportunities for European defense firms to sell more easily to Canada. The opportunities for the Canadian industry are more limited. End product manufacturers will get some orders through SAFE, provided they use enough European components. For Canadian component manufacturers, however, the deal changes little.

The SAFE rules allowing non-EU countries to sign participation agreements with the EU also permit those agreements to lift the 35% cap. But the 1 December agreement with Canada—the text of which is not yet public—does not, Regnier told The Arsenal.

Canada didn’t push for it to be raised because there’s little prospect of Canada getting many of its components into end products assembled in Europe.

A similar agreement Britain was negotiating—and walked away from—would have raised the cap, Regnier said. For the British, “it would have really made sense to go beyond the 35% limit,” Regnier said, because Britain’s defense industry is a lot more integrated with the European market than Canada’s.

Canada will pay €10 million up-front to participate in the program, Regnier said, but the final amount will depend on how much European countries end up buying from Canada. The fee is a fraction of the billions Britain would have had to pay, reflecting the relatively small number of European orders Canada’s defense industry is expected to get.

2. NATO’s innovation agency names startups picked for its 2026 accelerator program

The 150 companies will receive grants of €100,000 each to develop solutions in ten fields, including communications technologies, unmanned systems, and maritime and extreme environments.

NATO’s Defense Innovation Accelerator for the North Atlantic (DIANA) runs an annual, two-phase ‘Challenge Programme’ to support startups developing technologies with the potential to meet alliance needs. Besides money, startups get access to industrial partners, military end-users and potential investors.

DEFENSE INDUSTRY TAKEAWAY: The 2027 call will open sometime in the summer of 2026, after which startups have six weeks to apply. The challenge topics aren’t yet decided, though they have grown over the years and sometimes get repeated.

This is phase one, which will last six months. Not all 150 will make it to phase two, which includes an additional €300,000 grant each and more tailored support.

“DIANA manages a portfolio of potential solutions for each challenge area, which mitigates the risk of any one company or technology failing,” a program spokesperson told The Arsenal in an email.

Here are the 2026 challenges, up from just three categories in 2024:

Energy and power (included in the 2024 and 2025 challenges)

Advanced communication technologies (included in the 2024 challenges)

Contested electromagnetic environments (included in the 2024 challenges)

Human resilience and biotechnologies (overlap with 2025’s “human health & performance”)

Critical infrastructure and logistics (included in the 2025 challenges)

Operations in extreme environments

Maritime operations

Resilient space operations

Autonomy and unmanned systems

Data-assisted decision-making

Selected companies include:

Culture Pulse (Slovakia, data-assisted decision-making): An AI system designed to provide “early insight into high-risk shifts in public sentiment, misinformation, and group behaviour.”

DroneTector Limited (UK, autonomy and unmanned systems): Sensors to detect and track small drones.

OLEDCOMM (France, contested electromagnetic environments): Light-based communications for stealth drones resistant to jamming.

Herges Detection GmbH (Germany, human resilience and biotechnologies): Detection of home-made and military-grade explosives using colorimetric analysis.

Oceano Robotics (The Netherlands, maritime operations): Monitoring undersea cables.

3. EU leaders to discuss drones, electronic warfare, air defense and EDA

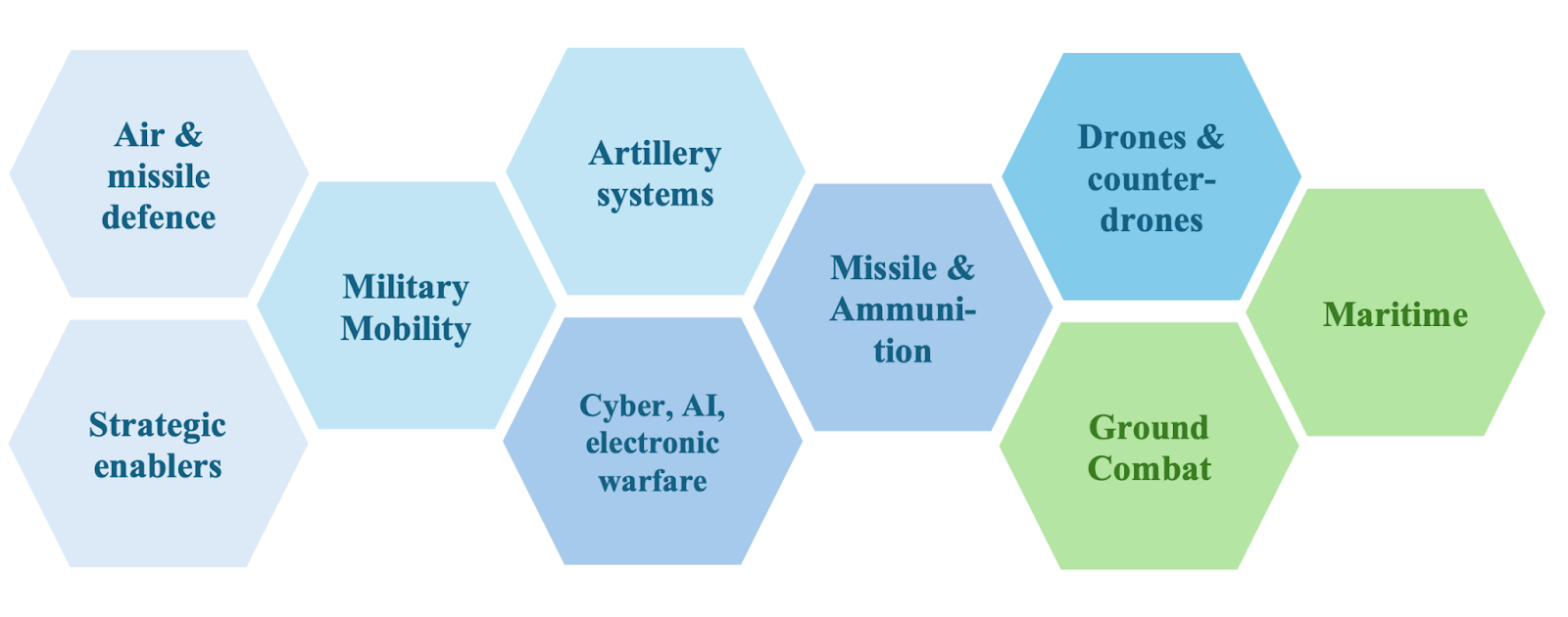

EU heads of state and government will meet in Brussels on Thursday/Friday to discuss efforts to enhance the bloc’s military capabilities in nine key areas, including drones, artificial intelligence, electronic warfare and air defense.

They will also discuss strengthening the European Defence Agency (EDA), which wants a bigger role in R&D, capability development and joint procurement.

DEFENSE INDUSTRY TAKEAWAY: A stronger role for the EDA could lead to more joint procurement, which the agency helps to coordinate and sometimes execute. That means opportunities for defense firms can be larger and more transparent, which would likely benefit smaller suppliers. The EDA is pushing for a supporting role in the nine planned “capability coalitions.” That can lead to joint procurement, which is likely to favor European suppliers.

The EU’s planned ‘capability coalitions’: Defence Readiness Roadmap 2030, European Commission, CC BY 4.0.

On 8 December, EDA Chief Executive André Denk told reporters in Brussels that the agency can help member states implement the capability coalitions. He also highlighted work the EDA had done in brokering an agreement among 17 EU defense ministries to cooperate on the procurement of loitering munitions, also known as kamikaze drones.

He hinted that a bigger role for the EDA, particularly in procurement, might mean more staff and more money.

The EDA has a 2025 budget of more than €50 million and around 180 staff—15 of whom handle procurement. That’s puny compared to some national procurement agencies.

Professional movement, promotions and industry news.

Know someone in the defense tech space who has made a professional move? Drop us a line at [email protected]!

The Arsenal is looking for a full-time reporter in Berlin!

You’ll help track developments in Germany’s growing defense-tech ecosystem — including procurement, startups, regulation, and cross-European partnerships.

Strong English and German language skills are required, along with curiosity about technology, national security, and policy. Prior expertise in defense or regulation isn’t necessary — we’ll teach a motivated and detail-oriented candidate the rest. Interested candidates should reach out to [email protected]

Romania has appointed Clara Volintiru as state secretary for foreign affairs—equivalent to a deputy minister. Volintiru has led the Bucharest office of the German Marshall Fund of the United States since late 2022.

Britain will appoint Lieutenant General Sir Rob Magowan of the Royal Marines to lead the armed forces’ Cyber and Specialist Operations Command (CSOC), overseeing special forces, cyber operations and military intelligence, according to a report by Larissa Brown for The Times.

Terma’s senior vice-president and head of customer strategy, Steen Lynenskjold, announced on LinkedIn that he’s leaving the company after 36 years to take a career break.

British defense firm QinetQ is hiring a billing specialist at its Farnborough site in Hampshire, southeast England. More information is available on the company’s careers page.

Our publication will be putting up a paywall in the new year. Interested in our B2B subscription packages? Register here to learn more.

Avientus develops autonomous fixed-wing vertical take-off and landing (VTOL) unmanned aerial vehicles (UAVs) with superior capabilities. Our multi-purpose systems carry mission-critical payloads such as food, ammunition, medical aid, spare parts and equipment, independent of roads or runways.

Capable of 80-100 km range with 10 kg of payload at speeds up to 140km per hour, these man-portable drones can operate even in GNSS-denied environments. Low-noise cruise mode and low unit costs (below €12,000) make Avientus drones rapidly deployable, easy to operate, and ideal for resilient bi-directional resupply at the tactical edge. Contact: [email protected]

The Belgian federal government is considering a law to allow operators of critical infrastructure to use drone-jamming technology, La Libre reports via Belga news agency. The current rules only permit police and military use.

Belgium has also agreed a €2.8 million drone-defense contract with Australian supplier DroneShield, Le Soir reports via Belga.

The European Commission is considering a second version of its SAFE loans-for-armaments program, Andrew Gray reports for Reuters.

Marine Le Pen criticized European defense programs—including the European Defence Fund, an R&D scheme—as wasteful, and hinted that she’d axe the struggling Future Combat Air System (FCAS) if elected president of France in 2027, Laura Kayali reports for Politico.

France’s Emmanuel Macron, Germany’s Friedrich Merz and Spain’s Pedro Sánchez are expected to discuss FCAS in Brussels this week, amid disagreements among their defense ministers, Reuters reports.

The German government has rejected calls for a multilateral rearmament bank, Maria Martinez and Sabine Siebold report for Reuters.

Polish defense minister Wladyslaw Kosiniak-Kamysz argued for a European “bomb bank” in an interview with The Times.